Governor Cooper looks to waive state income tax on student loan forgiveness

RALEIGH, NC (WWAY) — It’s been nearly a month since President Joe Biden announced student loan forgiveness for millions across the country.

Currently, any student loan forgiveness received by borrowers is ineligible to be treated as federal taxable income due to the American Rescue Plan. However, the North Carolina General Assembly did not adopt Section 108(f)(5) of the IRC for purposes of the state income tax. Therefore, student loan forgiveness is currently considered taxable income in North Carolina.

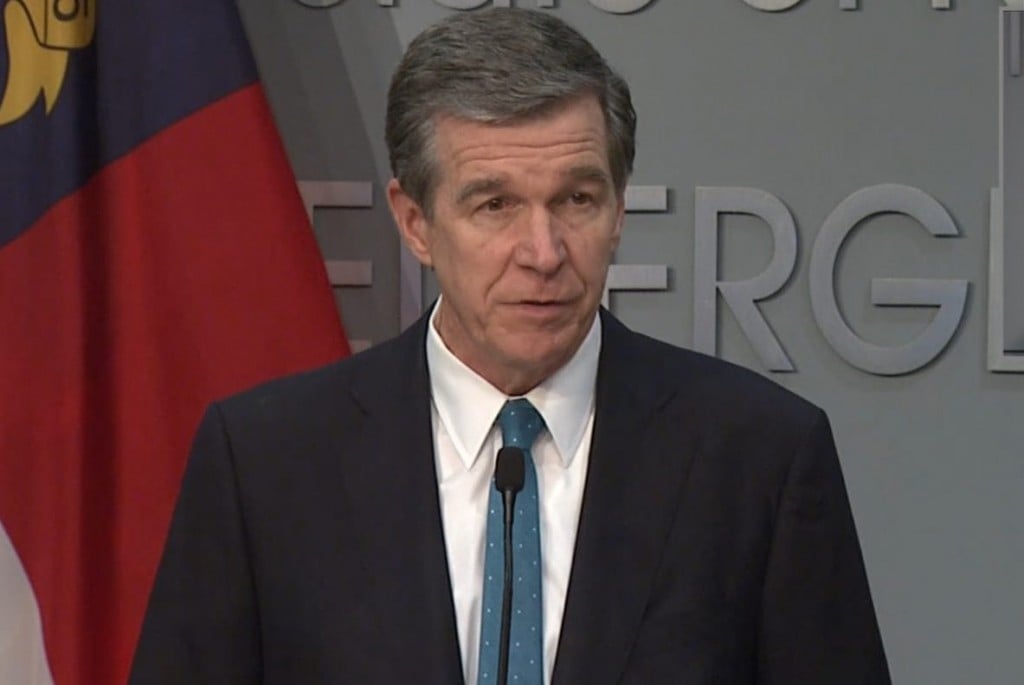

Governor Roy Cooper has called on legislators to waive state income taxes on student loans that have been forgiven.

“Legislative leaders need to find a solution that treats student loan forgiveness the same way they handled the PPP loan forgiveness that many of them received,” Governor Cooper said. “Republican legislators were quick to help businesses and should now fix this fundamental unfairness for many hardworking people who will get hit hard by this.”

Under the federal program, individuals making less than $125,000 in annual income will be eligible for student loan forgiveness up to $10,000. The amount increases to $20,000 for individuals who received a Pell Grant.